By cuterose

What Is Car Sales Tax In California

If you are looking to sell your car in California, you will need to know what is California car sales tax. This particular type of tax applies to all types of car sales and transactions. The amount of sales tax applied to your transaction will depend on many factors. These include the age of your vehicle, its value, the place where you live, and the amount of money you have to pay as a sales tax to the government.

One of the most important things to know about what is California car sales tax is that you are charged this tax even if you don't have a California DMV sticker on your vehicle. Also, vehicles that are outfitted with air bags, alarms, or other options that are designed to protect drivers from the risk of theft will usually be priced higher when they are sold. A lot of people don't realize this, but these added features can actually help reduce the amount of California sales tax they pay.

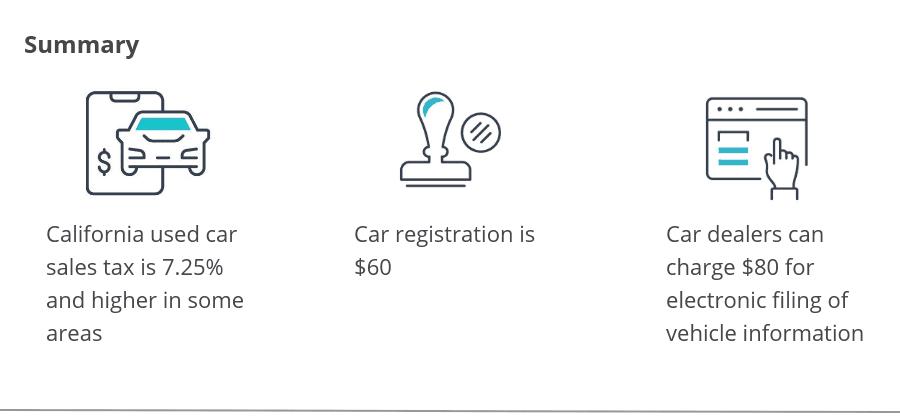

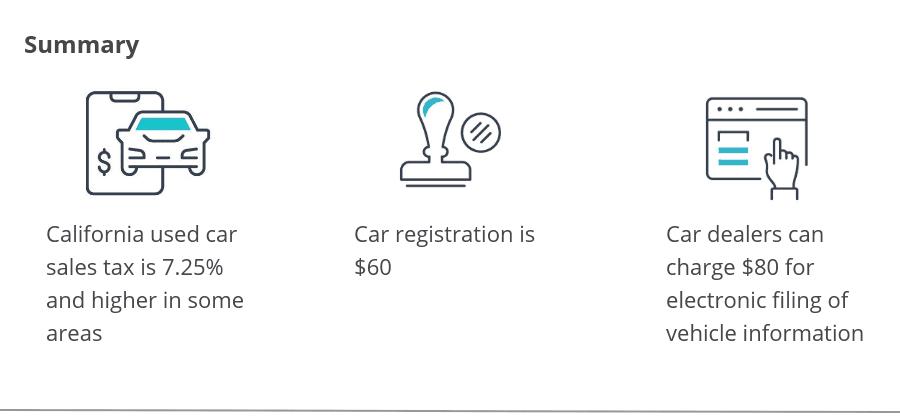

Car sales tax is calculated by adding your vehicle's current market value and the amount of money you owe in state taxes. This includes licensing and registration fees as well. The amount of sales tax that is applied to the sale of a vehicle will also depend on a few other factors. These include the age of your vehicle, its condition, and its value.

There are many ways you can get the total amount of California sales tax you will be charged. You can calculate this yourself by using the online California sales tax calculator. You can also contact the IRS for a copy of the sales price. Either way, your final tax amount will be less than the sticker price.

When you go to sell your vehicle in California, you must be aware of what is called an "exemption". An exemption is something that California uses to encourage people to buy cars. You must be aware of what is called an "exemption". The best way to find out if your car is eligible for one is to contact the local DMV.

One of the biggest questions you may have is about sales tax on used cars in California. You should know that this is different than the sales tax on new cars. The difference between the two is that when you consider sales tax on a used car, you are only considering the retail price. You do not include the wholesale price, which is what you would pay at a dealer. When you consider sales tax on a new vehicle, you consider the entire cost, including the price of all applicable fees. All transactions involving a used vehicle and sales tax are considered separate transactions and will not be consolidated under the sales tax laws of California.

One of the final questions you may have is regarding the ongoing monthly registration fee for your vehicle. This fee can be very confusing and most people do not understand it. If you get caught up in the sales tax laws of California and do not understand how much your registration fee is, you should contact the DMV and ask them how it works.

These are just a few questions to ask yourself when thinking about California sales taxes. You will want to ensure you fully understand what you are purchasing and how it will affect the sales price. In the case of what is car sales tax in California, you need to make sure you pay the requisite amount of taxes and fees, otherwise, the transaction will not go through and you will owe the state money. Understanding what the sales tax is applied to what vehicle can help you plan your purchase.