By cuterose

5 easy ways to keep your devices and data safe: Fortify your passwords, back up your files

It’s a new year and a fresh start, and so many of us are looking to improve something about ourselves in 2022. For some, it could be a more focused path to physical wellness, such as exercising more, eating healthier foods or quitting smoking.

Naturally, this is also tied to your mental health. And hey, given the events of the past (almost) two years, it’s understandable to prioritize mindfulness and meditation tools and techniques this year.

And in this day and age, you should also consider your digital wellness, too.

From phishing scams and malware (malicious software), like ransomware – in which your files are held hostage unless you pay up – cybercriminals are becoming increasingly sophisticated and relentless.

► Ransomware 101:What to do if you get hit by an attack

“The line between our digital lives and our real lives have blurred – your digital life is your real life,” says Hari Ravichandran, CEO and founder of Aura, a leading digital security company. “Our reliance on the internet has increased, especially as the pandemic forced us to spend more time at home and connected through our devices.”

Ravichandran says about $4.1 billion was lost to internet crime in 2020, according to the FBI’s Internet Crime Report, up 17% from 2019.

“While 2021 data has yet to be released, we expect this number to have grown even more in the past year,” Ravichandran says. “Cybercriminals are no longer the lone hacker behind a computer – they’re criminal enterprises and working overtime to steal your personal information and finances, which could put a huge strain on any family.”

The good news is you don’t need a degree in computer science to safeguard your data and devices. Here is a simple checklist:

1. Use strong and unique passwords and pass phrases

Your first line of defense is to have a strong password for all your accounts, which is at least seven characters long and a combination of letters, numbers and symbols (bonus points for adding upper and lowercase characters).

Avoid easy-to-guess passwords, like “123456789” or “password,” or ones that include kids' or pets' names, your date of birth and other easy-to-guess passwords.

Never use the same password for all your online activity, because if a site or app is breached, then the crooks have access to all your online accounts.

Or you can use a pass phrase instead of a password, such as “1lovemyc@tM0lly” (derived from “I love my cat Molly”).

Even better, opt for “multifactor authentication,” which not only requires your password to log in but also a one-time code sent to your mobile device, to prove it’s really you. In other words, two-factor authentication combines something you know (password) with something you have (phone).

Reputable password manager apps – like 1Password, Dashlane, Roboform and LastPass – are a good idea. Many cybersecurity suites already include a password manager, such as the one offered by Aura (see tip No. 2).

2. Update software and practice good cybersecurity hygiene

Companies periodically find vulnerabilities with their software and release updates or “patches” that fix them.

So, be sure to set up automatic updates on all your tech, including your operating system, web browser, apps and other software so you don’t need to remember to do it.

For software that doesn’t allow for automatic updates, check for updates regularly.

On a related note, be sure to use reliable cybersecurity software to fight malware.

Updated annually, good cybersecurity software can identify, quarantine, delete and report any suspicious activity. It will automatically update itself with protection against the latest threats – but don’t forget to renew when it’s time so you’re protected against the latest threats.

Often included in cybersecurity suites, a virtual private network (VPN) is also a good idea because it conceals your online whereabouts from those who might profit from tracking your activity.

“There used to be a time when you needed upwards of five solutions to even remotely protect your finances, devices and identity online – and even then, solutions acted more like glorified alarm bells that only notified you after the damage was done,” Ravichandran says. “Today, protecting yourself digitally doesn’t need to be difficult or stressful.”

“A (cybersecurity) platform should be simple and easy-to-use, because not everyone should have to be a tech expert to avoid identity theft and financial loss online.”

► Online fraud:Avoid endangering yourself by stopping these 4 behaviors

► VPNs:What are they and why do college students need to use them?

3. Common sense prevails

Software can help protect you, but you can do your part, too, to remain vigilant.

Watch out for scams in the form of authentic-looking emails and texts. These “phishing” attempts are meant to “lure” you into giving out personal or financial information, which can be used for identity theft.

In other words, never tap or click on an email, text message, or pop-up message from a company that asks you to urgently confirm private information – even if it looks legit – because it’s probably bogus. Your bank, financial institution or credible online payment service (such as PayPal) will never ask for sensitive information via email or text message. When in doubt, contact the company by visiting the actual company’s website to find a phone number or email address (and not from the contact details inside of the email or text in question).

Similarly, if someone calls you and says they’re from Microsoft or an IT department and they detect a problem with your device and so you must follow instructions to fix it, it’s also a scam – hang up on them immediately. Many will ask for permission to take control over your computer to “help” you.

Anecdotally, my 82-year-old mother just got one of those calls this past week – and she almost fell for it.

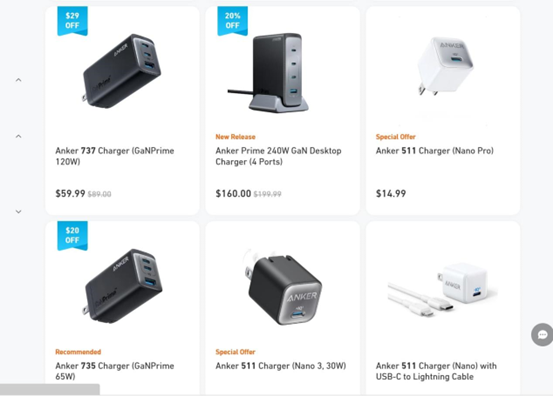

4. Shopping online? Ensure it’s a secure connection, payment method

Always use a secure Internet connection when making a purchase.

Reputable websites use technologies such as SSL (Secure Socket Layer) that encrypt data during transmission. A webpage is secure if there is a locked padlock in the corner of a browser or if the address starts with “https” instead of “http” (the “s” stands for “secure”).

Resist shopping over free public Wi-Fi hotspots, because it could put your credit card info and passwords at risk. Instead, use your smartphone’s cellular service or wait until you’re at home on a private wireless network.

Shop only on sites that take secure payment methods, such as credit cards and PayPal, because you’ve got buyer protection – just in case there’s a dispute. That is, if the product never ships, if it’s not what you ordered, or if your Christmas gift arrives sometime in February, then you have some recourse. Plus, you won’t be liable for any fraudulent charges.

Carefully scan your credit card and bank statements every month and immediately report anything suspicious.

Pro tip 1: It’s recommended to use a store’s app instead of a web browser, if it’s offered, because it’s generally safer.

Pro tip 2: Use gift cards instead of credit cards, if the online retailer offers it, to shop without providing any financial information.

5. Backups are a no-brainer

No one thinks they’ll be hit with a cyberattack, so most of us are reactive rather than proactive when it comes to protection.

But if you’re going to do at least one thing, back up your important computer files on a regular basis – just in case.

This can be handled automatically, thanks to the many free scheduled backup programs available today, or manually, where it’s up to you to select which files to backup – say, in Windows Explorer (on a PC) or Finder (on a Mac) – and then copy them to an external hard drive, USB thumb drive, or perhaps uploaded to a cloud account (like iCloud, OneDrive, Dropbox or Google Drive).

As the proverb goes, an ounce of prevention is worth a pound of cure.